Funding the energy transition

A common barrier for organisations when deciding whether to consider an energy efficient technology project is how to fund it and whether the funding would be better used elsewhere in challenging financial times. Finance expert Luiz Filho ACMA, CGMA, MBA explores the challenges and opportunities available to organisations when funding their energy transition.

We want to invest in energy projects but…. Investing in energy efficient technology projects is often not the highest priority for businesses regardless of sector. For example, hotels may prioritise the renovation of rooms before replacing boilers or schools may require their kitchen facilities to be upgraded prior to more efficient LED lights being installed.

Even though energy efficiency projects can yield high returns over the mid to long-term and contribute to a low carbon society, businesses do not necessarily decide merely on financial grounds and corporate social responsibilities. Often there is a focus on short-term savings or cash generation which of course is understandable, particularly during difficult times. After all, hotels need to accommodate their guests and students need their meals. If boilers and lights still deliver, then perhaps improvements in those areas can wait for a ‘better time’. But when is a ‘better time’?

How to fund energy efficient projects

Fortunately, the energy sector in the UK has grown progressively over the years and customers can procure from a wide range of energy suppliers and hardware providers. Competition in the marketplace means that in order to retain customers over the long term, suppliers must provide solutions that reduce energy spending and carbon emissions in their offers.

Moreover, such solutions must be self-funding from a customer perspective, which means that businesses may only adopt the transition under marginal capital requirements on their part.

Government policies designed to accelerate the transition to energy efficient projects have been helping suppliers and their customers to adopt the change.

One of the first examples was the transition to solar energy under new Power Purchase Agreements (PPAs) where suppliers would install and own solar panels on customers’ rooftops and charge them for the energy they consume, hopefully below market price. Customers realise financial savings while reducing carbon, and suppliers realise return on investment from a long-term subsidised PPA. These days even batteries can be part of the offer which should improve both financials and quality factors.

An opportunity for low carbon heating systems? Heating demand in the UK is one of the main causes of carbon emissions. Businesses use large amounts of gas, oil and in some cases coal to provide heating in off-grid locations. According to the International Energy Agency, heat accounted for 50% of global final energy consumption in 2018. Heat is the largest energy end-use and contributes 40% of global carbon dioxide (CO2) emissions. It is a significant bill in most buildings.

Commonly heating is provided by inefficient older boilers that continue to operate through ad-hoc maintenance because the cost to replace is deemed too high or is seen as a low priority. However, when calculating how much additional fuel is consumed plus the ongoing maintenance costs, an inefficient boiler is expensive to run. The energy transition to cleaner and more economic alternatives such as heat pumps is long overdue.

In the same way that the solar energy industry has matured to fund projects via PPAs, cleaner heating solutions can be funded via Sale of Heat contracts where customers pay for the heat they use by agreeing a tariff which recovers electricity or gas, hardware and even maintenance of the new more efficient system.

Realising ROI in energy efficient projects Some customers may find that PPAs and Sale of Heat contracts requiring longer term contractual agreements may not suit their business models and, in these instances, employing capital in energy efficient projects rather than suppliers funding the transition is a completely valid strategy.

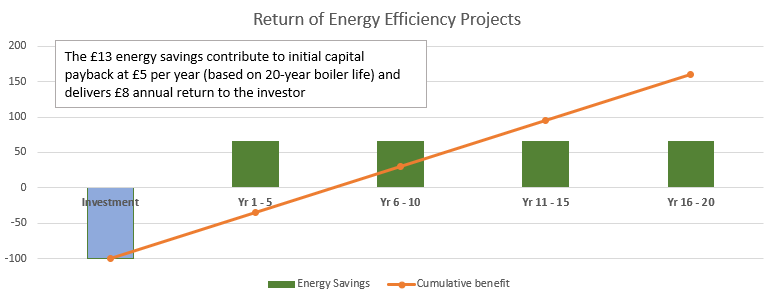

If your business has enough capital to fund all the priorities including for example boiler replacement, then such investment is certainly a wise decision since the projects usually yield over 8%+ per year over the longer-term.

From a risk-reward perspective, energy-efficient projects are an excellent choice to the investor because annual energy savings are quite predictable – the demand is well-known based on available data. Therefore, an 8% return performance is well above most low-risk fixed-income investments.

Need help deciding which energy-efficient project to take? ecoDriver Solutions can help you assess the best routes to funding, financial savings and carbon reduction in your business today. If you would like to know more, contact us.